ri tax rate on unemployment benefits

However the State of Rhode Island will use the same tax rate schedule for 2019 that it used for 2018 -- Schedule G. This is what a 1099-G looks like.

Many Employers Face Higher State Unemployment Insurance Tax Costs Due To Covid 19

The TDI Taxable Wage Base for Rhode Island employees will be 81500 in 2022.

. Reminder about taxes on unemployment benefits. To receive free tax news updates send an e-mail with SUBSCRIBE in subject line. The rate for new employers will be 116 percent including the 021 percent Job Development Assessment.

If you have received Unemployment Insurance benefits and would like to download and print a 1099 G form for income tax filing purposes enter the information requested below to view your form. Effective January 1 2021 the Unemployment Insurance Tax Schedule will go to Schedule H with tax rates ranging from 12 percent to 98 percent. Accordingly in 2022 the UI taxable wage base for most Rhode Island employers will remain at 24600.

BENEFIT RATES as of 1122. Your weekly benefit rate remains the same throughout your benefit year. Thursday December 16 2021.

UI Customer 1099 Form. The easiest way to apply for benefits is online at the link above. UI tax rates are calculated using a statutory formula based on the balance of the states employment security fund.

The UI taxable wage base is set at 465 percent of the average annual wage of workers at taxable employers. Because of the high. View the Guide to Filing a Claim.

You can also earn up to 50 of your weekly benefit rate before any earnings are. 52 rows You may receive an updated SUTA tax rate within one year or a few years. For detailed instructions on how to use this page please click the Instructions button.

- The states seasonally adjusted unemployment rate was 51 percent in November the Department of Labor and Training announced Thursday. Subscribe for tax news. UI tax rates are calculated using a.

For most Rhode Island employers the taxable wage base for calculating the Rhode Island unemployment insurance UI tax will be 23600 for 2019 compared with 23000 for 2018 an increase of 600 or 261 percent. Unlike federal government RI will fully tax unemployment benefits. 29 rows The employer tax rates in these schedules include a 021 Job Development Assessment which is credited to the Job Development Fund and a 003 Reemployment Assessment for calendar years 2001 2002and 2003 that is credited to the Employment Security Reemployment Fund.

For Interstate claims out of state call 866 557-0001. 2022 Tax Rate 11 percent 0011 The Temporary Disability Insurance contribution rate will be 11 percent for calendar year 2022. UNEMPLOYMENT TDI TCI INSURANCE INSURANCE TAXABLE WAGE BASE 24600 74000 For Employers at the highest tax rate 26100 TAX SCHEDULES Schedule H.

For example the SUTA tax rates in Texas range from 031 631 in 2022. 13 TAX RATES 120 to 980 Deducted from Employment Security 099 to 959 Employees Wages Job Development Assessment JDA 021 NEW EMPLOYER RATE 095 not including 021. If you receive Form 1099-G from the Rhode Island Department of Labor and Training for unemployment benefits you did not file for or receive please report it at the button below.

The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022. Tax Schedule F with rates ranging from 09 percent to 94 percent was in effect in calendar year 2020. Only four other states.

Guide to tax break on pension401kannuity income. It protects workers against wage loss resulting from a non-work related illness or injury and is funded exclusively by Rhode Island workers. This is an increase of 7500 101 from the 2021 taxable wage base of 74000.

UI tax rate schedule that applies to all employers could change for 2021. It is hoped that delaying the SUI tax computation date to as late as November 30 2021 will allow the states UI trust fund balance to further recover before determining the rate. UI provides temporary income support to workers who have lost their jobs through no fault of their own and have earned enough wages within a specific base period to qualify.

It is a tax form that provides information on benefits paid in 2020. Generally states have a range of unemployment tax rates for established employers. You can now earn up to 150 of your weekly benefit rate and still receive a partial benefit.

WPRI Any Rhode Islanders who received unemployment benefits during 2020 will have to pay state taxes on. For Workshare claims call 401 462-8418. For those employers at the highest tax rate the UI taxable wage base will be set 1500 higher at 26100.

The Rhode Island UI tax rate schedule known as the experience rate table Schedules A I under Rhode Island General Laws 28438 is determined based on the amount. Unemployment Insurance UI is a federalstate insurance program financed by employers through payroll taxes. Rhode Island unemployment insurance UI tax at a glance 2020 2021 Taxable wage base 24000 24600 Tax rate schedule F H Tax rate range 069 to 919 099 to 959 Tax rate ranges do not include the 021 assessment for the Job Development Fund which is the same for 2021 as it.

Your state will assign you a rate within this range. If youd prefer to file your claim over the phone please contact us at 401 415-6772 to file a claim during normal business hours. McKees recently issued Executive Order 21-102 which delays the deadline of September 30 2021 for computing the 2022 state unemployment insurance SUI tax rates.

How to contact us make payments or use our drop box. Rhode Island Governor Daniel J. For example that means if your weekly benefit amount is 100 you can earn up to 149 working part time.

The 2021 TDI Contribution Rate was 13 percent. Most states send employers a new SUTA tax rate each year. Unemployment claimants can earn more and keep more of your benefits while working part-time.

Your weekly benefit rate will be equal to 385 of the average of the total wages in the two highest quarters of the base period not to exceed the defined maximum amount. Effective 1222 the minimum is 62 and maximum is 661 not including dependency allowance. New York New Jersey California and Hawaii as well as the commonwealth of Puerto Rico have a TDI program.

The Department of Labor and Training DLT on Monday announced that tax rates for the Unemployment Insurance UI program will remain at Schedule H in 2022.

Here S Where The Jobs Are In One Chart Cnbc Job Marketing Data Stock Quotes

State Income Tax Rates And Brackets 2022 Tax Foundation

R I Keeping Unemployment Insurance Tax Rate Unchanged In 2022 Providence Business News

Increasing The Taxable Wage Base Unlocks The Door To Lasting Unemployment Insurance Reform

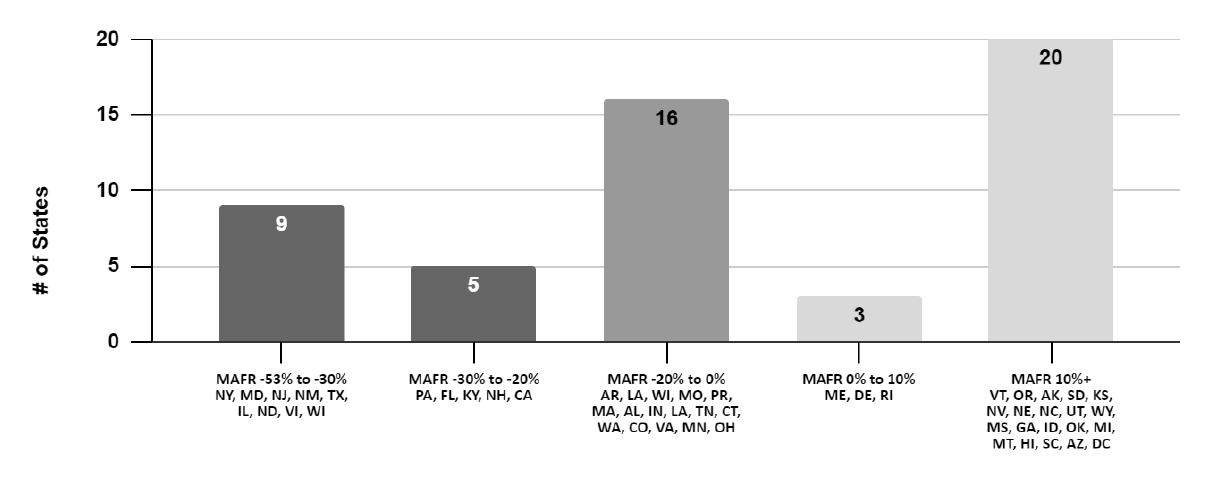

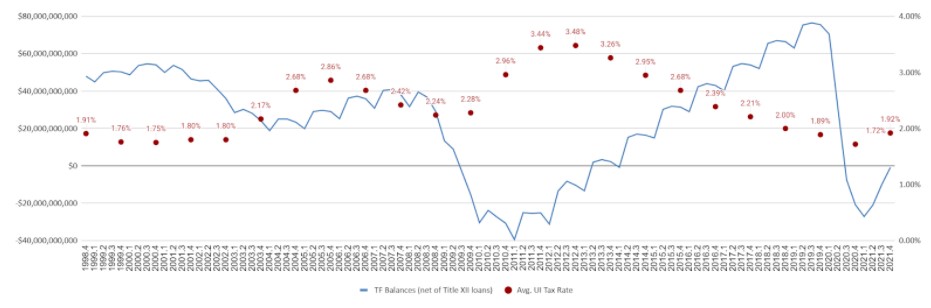

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

2022 Sui Tax Rates In A Post Covid World Workforce Wise Blog

5 Facts About The Minimum Wage Minimum Wage Wage District Of Columbia